MENA Fintech for School Fees zenda Raises $9.4M for India Expansion

The startup has its eyes firmly set on $70 billion in annual transactions in a lacking school fees payment ecosystem in India.

While fintech in the MENAP region has long been associated with digital literacy (or lack thereof) and the unbanked, an increasing number of startups across the region have been innovating financial technology for more niche purposes. One such startup is zenda, which has leveraged fintech solutions to target school fee payments.

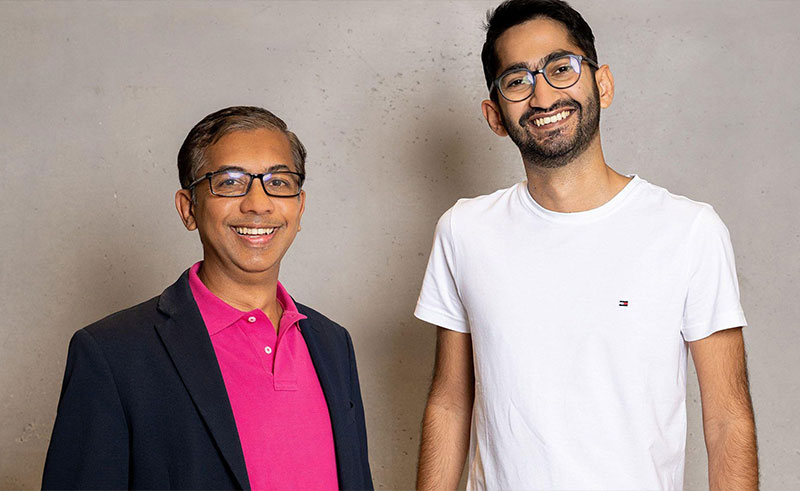

Based in Dubai, but with offices also in India Bangalore and Kochi, zenda has announced the raise of an oversubscribed $9.4 million seed round that saw participation from the likes of STV, COTU Ventures, Global Founders Capital and VentureSouq. The startup was founded by Raman Thiagarajan and Haseeb Ahmed in 2021 to tackle the lack of convenience and flexibility in payment options for school fees, especially for lower income households. That lack of flexibility can be seen on several fronts, starting with the fact that most school fees are required to be paid bi-anually, while most payment methods are non-digital, which as we know offers plenty of opportunities in the sweeping wave of fintech solutions washing over the region. zenda allows users to efficiently track their dues and make payments through several of pay-now and pay-later options, while also unlocking rewards for paying on time. With around $37 billion processed annually in fee payments to private educational institutions in the GCC and $34 billion in the rest of Middle East and Africa, zenda is poised to take aim at a huge market.

“In today’s digital world, we seek low friction and immediacy - why should that not be the case for fee payments? Part of the ecosystem still runs on cash or cheque with no convenient option to pay later,” explains Raman Thiagarajan, who also serves as the zenda CEO. “ zenda schools are witnessing a systematic increase in their collections. We are excited and hopeful for the possibilities ahead – in providing customer-centric digital financial services to solve some of the simple yet important problems for families in our regions”

Pakistan’s fintech sector has been experiencing a fine run of form, starting from 2021 and through to Q1’22, which has seen it rank first in terms of number of deals completed and second in overall funding, with standout deals including NayaPay’s $13 million seed round, MyTM’s $6.9 million seed and an undisclosed pre-seed for Taro Technologies. Most recently, the country’s first financial wellness platform, Abhi, raised a $178 million Series A round.

While e-commerce proved to me the most prolific sector in terms of investments in 2021 with $202 million raised, fintech came second. Across 16 deals, Pakistani fintechs raised $95 million, a figure that represents a 2,500% YoY growth in funding.

With their new capital, Thiagarajan and Ahmed intend to expand in India, where approximately $70 billion worth of transactions are swirling around the school fees payment ecosystem.