The Inflation of Bouncy Castles

Up and down, up and down, up and down... Bouncing might be fun, but soon enough, you'll get dizzy as Nathan Anderith finds out.

In this world of wrath and tear, it’s nice to know there are still places of peace; havens where the thousand pricking pains of life can be set aside, where you can emancipate yourself from the mundane slavery of reality and enter a state of simple, joyous bliss. I am talking, of course, about bouncy castles.

I was lucky enough to see a bouncy castle at a wedding the other day - a gaudy and fantastic affair with towers and battlements and colors and whatnot. It even had two separate chambers, and a few dozen shrieking kids bounded back and forth, slamming into each other, doing flips, falling over, and generally having themselves a blast. It was a startling bit of joy in a city that’s generally been pretty gloomy lately, and I stopped to soak it in for a while, like a blast of AC on a hot day.

There was a leak in the castle somewhere, so one room was always a little less inflated than the other, and a guy with a big mechanical air pump ran back and forth, filling up one side then the other. He looked like a Ghostbuster bailing out a lifeboat. I felt for him – inflation can be hard to manage, whether you’re a bouncy castle technician or the Central Bank of Egypt. Although this guy was doing a hell of a lot better job than the CBE.

The CBE (it’s called the Federal Reserve in the US) isn’t like a normal bank. You can’t walk in and use the ATM. They’re the guy with the air pump, trying to keep the economy roughly in shape and make sure the whole thing doesn’t collapse on top of dozens of shrieking children. The economy’s bouncy castle economy has two rooms: spending and saving. Different economies have different ratios, but generally you want people saving more when times are good and spending more when times are bad.

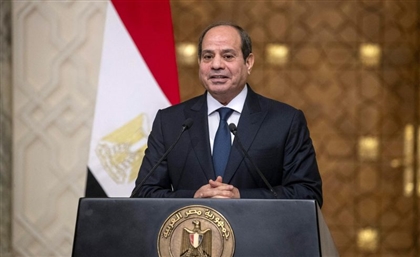

Last week, those carnie wannabes raised interest rates by half a percent, and I’m still trying to figure out why. It’s supposed to reduce inflation, but it won’t do a damn thing except screw up the economy more and get the government deeper into debt.

Let’s back up a bit. Inflation (the money kind, not the bouncy kind) is what makes prices go up. It’s been a serious problem in Egypt for a while now, wandering between an 8 and 11 percent increase every year, but recently it’s shot up fast, spiking prices on things like food and clothes. You know, the trivial stuff.

The common definition of inflation is “too much money chasing too few goods,” which is the definition the CBE’s operating under. The idea is that there’s just too much money in the market; the spending side of the bouncy castle is over-inflated (see what I did there?). So the central bank grabs a hose and moves some air over to the savings side by cranking up interest rates. The idea is that if you make more money off your savings, you’ll leave it in the bank instead of spending it. More money saved, less in the market, so prices don’t rise as fast – that’s the theory, anyway.

“But wait,” you say. “This is Egypt we’re talking about. We’re broke as shit! Why would you want to pull even more money out of the market?”

Congratulations, you’re smarter than the Central Bank of Egypt. You see, the whole “money chasing goods” thing is just one possible cause of inflation. Sometimes shit gets more expensive because there’s too much money – maybe the bank’s been printing money or the economy’s growing too fast. But sometimes shit gets more expensive because shit gets more expensive. Noticed those long lines outside of gas stations that stretch down the street? When you don’t have gas it’s a lot harder to move your products to market. The value of the pound’s been falling, increasing the prices of the stuff Egypt has to import, which last time I checked is roughly every goddamn thing. None of this is going to be changed by the CBE screwing around with interest rates, and they know it; hell, they even said so in the same press release where they announced the rate hike.

What it will do is hurt the economy. Businesses need loans to expand, or sometimes just to keep basic operations going, and now those loans are going to be more expensive. The government takes out loans, too, so its debt is going to get bigger faster. The half of the population that actually keeps savings accounts will be less likely to buy things from businesses that employ people. The spending room will get smaller, the saving room will get bigger, but it won’t stop the leak that’s slowly bringing the bouncy castle down.

- Previous Article I Got Banged!

- Next Article Nomades Land