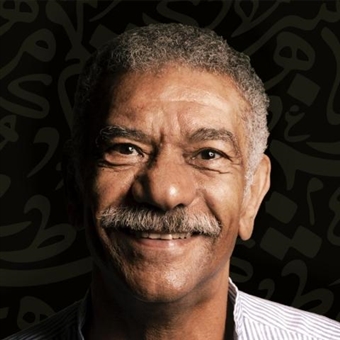

Loulou Khazen: How MENA’s Startup Ecosystem Evolved in the Past Decade

The voice behind ‘Conversations with Loulou’ tells us all about how much the MENA region’s ecosystem has changed over time.

Perhaps best known for her podcast ‘Conversations with Loulou’ - one of the top 10 ranked entrepreneurship podcasts in the Middle East - Loulou Khazen Baz is a woman who wears many hats. Over the years, Baz has been an entrepreneur, an investor and a podcaster, and through each of these roles, she has worked tirelessly to support the region’s startup ecosystem.

After founding Nabbesh, the Arab world’s first online marketplace connecting employers with freelancers, in 2012, which was later acquired by Ureed in 2020, she decided to focus on the next phase of her entrepreneurial journey. Baz built Spade Ventures, an angel syndicate for early-stage tech startups, and established her now-famous podcast for regional audiences.

“I think these two platforms will play a big role in further enabling the startup ecosystem, through information and education from the podcast, and through funding and support from Spade Ventures,” Loulou Khazen Baz tells StartupScene. “It’s nice to cheerlead and encourage people to become entrepreneurs and work in technology, but we also need an honest assessment in terms of where we are, where we want to go, and how we are going to get there.”

After being in the startup space for over a decade, Baz has witnessed the region’s ecosystem evolve and change with time. But while much progress has been made, more still needs to be done to take it to the next level.

CHANGES OVER TIME

-0b697966-0e6c-4567-98b8-d8266140d8bd.jpg)

The startup space was different in 2012. There weren’t as many entrepreneurs as there are today, investments were sparse, and the startup ecosystem was still considered nascent in the MENA region.

For Baz, launching and growing Nabbesh during this time was not easy. “There wasn’t enough money around to fundraise, and it took months to be able to get money,” she says. “There also wasn’t a lot of knowhow in the market, so that means that you’re going through a very steep learning curve on a shoestring budget with talent that hasn’t necessarily experienced being part of a scale up or a successful startup, so there was a lot of risk anywhere you looked.” On top of that, the concept of Baz’s startup - sourcing freelancers and remote talent for companies - wasn’t popular back then, making Nabbesh ahead of its time, as well as a big unknown.

But all of that seems to have changed. According to a report by Statista, startup funding in MENA grew 12% YOY from 2016 to 2019.

Although funding has been declining in the last few years, retreating 23% in 2023 compared to 2022 according to Magnitt, it’s still bigger than it was a decade ago, Baz explains. “It’s definitely gotten better, there’s definitely more money. Not a lot of money, but much more than there was back then,” she says.

As the startup ecosystem continues to grow, so do opportunities for founders, fueling more entrepreneurship in the region. “I think one of the most positive points in the startup ecosystem evolution is that you have a group of founders that have built a startup, gone through the experience, and lived to tell the story,” Baz explains. “And there are many people who have worked at startups, gained experience, and are starting their own companies, so I think a lot has been built on the back of our experiences and mistakes.”

WHAT INVESTORS ARE LOOKING FOR

For any startup to succeed, however, it needs funding, whether from founders, angel networks, or institutional investors. That’s why Baz launched Spade Ventures in 2019 to invest in early-stage tech startups in the Middle East.

“Even though we do invest upwards of $500,000, up to $2 million usually, we see ourselves as really opening up our network to support the founders we invest in,” Baz says. “So, building that network, selecting the startups, working closely with the founders after we invest as an advisor, it is a lot of work.”

Despite the opportunities that come with investments, Baz advises founders to be mindful when approaching investors. “It’s like any other relationship,” Baz adds. “If you like another person, you don’t just go to them, the first time they’ve ever met you, and you say ‘go out with me!’ There’s a process that happens. And I think, entrepreneurs are only thinking about their own problems, which is ‘how do I fund this company that I’m building?’.”

She adds that above all, investors want to love the founders they’re investing in. “Not ‘like’, but ‘love’,” she says. The reason is simple: investors will be spending a lot of time with founders, supporting them in building and growing their startups, so they must like being around them - a lot! “We’re people at the end of the day,” says Baz. “It’s normal, you want to like and love the people you’re working closely with.”

POCKETS OF OPPORTUNITY

With the ecosystem evolving and adapting to changing market trends, such as the funding crunch and geopolitical tensions, it has become clear that countries in the region have not been equally impacted. Saudi Arabia is quickly emerging as an attractive startup hub, raising $1.3 billion in 2023, according to Magnitt. Meanwhile, Egypt is seeing an exodus of startups to Saudi Arabia and other countries in the GCC as it struggles to navigate its economic challenges, while the UAE maintains its position as a leading business destination.

“I don’t think our region is one region,” says Baz. “You have Egypt which is experiencing extreme economic challenges, and it has driven a lot of the startups out of Egypt despite the size of the market. You have the rest of the Levant - Iraq, Lebanon, Syria - where there is a lot of instability. You have the war in Gaza, which could spill any day, and this is a massive risk. Then you have the GCC, such as Dubai, which has been the center of innovation, finance, economic activity, and startups for the longest time. And now you have Saudi Arabia, where the government has been allocating billions of dollars to be invested in startups since 2017 till today.”

What this leaves entrepreneurs are pockets of opportunities, particularly in the UAE and Saudi Arabia, where the economy is thriving and attracting talent from all corners of the world. Despite the economic disparity in the region, however, entrepreneurship remains an attractive opportunity for many in the Middle East. Besides the lure of high financial returns if their startups succeed, entrepreneurs are often driven to create impact and create meaningful change- something that will not go away with time. “You have a burning desire to create impact and do something meaningful,” says Baz. “You want to play your part in what is basically happening in our economy, in our country. There’s that drive that I’m going to fix this problem, I’m going to change this. I’m going to make this better.”

As technology continues to evolve, especially with the advent of AI, so will the solutions to tackle regional issues. Baz expects startups to start transitioning from simple digital transformations to more deep tech solutions. “I would love to see the day when we start moving from sort of the first layer of digital transformation, such as ecommerce and fintech, into more deep technologies, where we build food, cyber security, and energy startups, especially since it’s an oil rich region,” she says.

For now, though, Baz is playing her part in the ecosystem. She wants to get more people interested in the startup space, supporting entrepreneurs along their journey, from financing all the way to providing guidance and advice. “I would really like to become this sort of conduit, and give people outside of the startup ecosystem access to the startup space whether it’s through knowledge, insights and stories through the podcast, and by adding value via investing in the startup ecosystem,” she says. “I do this because I think this sector is extremely important, and I really see myself as the sort of in between point between the wider economy and the startup ecosystem.”

- Previous Article Italian-Palestinian Duo No Input Debuts Eponymous Electro EP

- Next Article Travel Across History on Egypt's Most Iconic Bridges