What the Hell Happened?

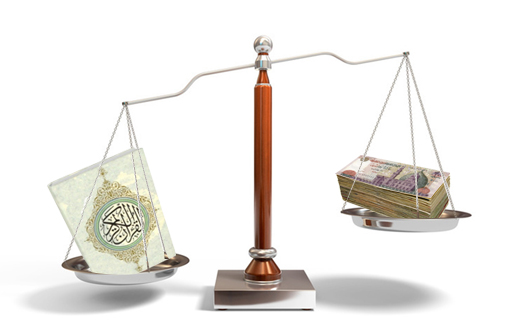

Once upon a time, the Islamic world was an economic force to be reckoned with. They had great financial models, fair inheritance laws and a good stance on interest. So when did we fall so far behind? Nathan Anderith explains...

Here’s something that confuses me: the Middle East used to be the dominant economic power in the world. Islam at its height stretched from Spain to Indonesia, an empire of millions united by faith, by language, and by lots and lots of money. You could write a cheque in Morocco and I could cash it in India; the trip would be safer than crossing Tahrir Square. Some of the greatest poets and pioneers were merchants - they were the cultural and economic skeleton of Muslim society, shipping ideas from Baghdad with silks from Bangladesh.

What the hell happened? The Middle East today has fallen behind the Western world in just about every economic and human development measure. It’s better than it was a hundred years ago, but not by a lot, except for the Gulf. Growth’s happening now, slowly, and reform, even more slowly, and in a decade or so we might see the Middle East become a real economic competitor (not just from oil). But why should that even be necessary? What turned the richest and coolest stretch of sand in the world into yesterday’s news?

Sometimes you hear people chalk it up to culture and religion, saying that Islam is fundamentally anti-capitalist. That’s hilarious, considering that, for about a thousand years, Muslims were the masters of international trade. All the structures were there: a strong math system, advanced navigation, rules of hospitality that kept travelling merchants safe. Sure, they had wars and bandits and whatnot, but trade kept moving a hell of a lot better than in Europe. It wasn’t even a fair fight -they had a common language, for God’s sake.

Most importantly, they had a set of economic laws that were widely accepted, so everyone was on the same playing field. And that’s where they eventually screwed the pooch. Most bad ideas are good ideas that got taken too far, and the roots of the Muslim economic malaise go back to some truly genius concepts that were never allowed to evolve. Two laws, in particular, were quite helpful right up until they crashed the Middle East economy: inheritance and interest rates.

Before I get any further into this and possibly raise some pulses, I want to stress the personal respect I have for Islam. It’s a faith and a people that I’ve lived with for three and a half years now, and everything I’ve seen (even what I’ve disagreed with) has only broadened my appreciation for the religion and its Prophet (peace be upon him).

My favourite thing about him is that he was a great economist. Long before he was a leader, he was a merchant, but he didn’t like monopolies of wealth so one of the first things he did when he had real power was set out some rules for property and trading. The inheritance laws were more progressive than almost anywhere in the world at the time, because they split your stuff among all your kids and relatives – even the women counted as people! Well, half-people, but it still beat the hell out of the European primogeniture, which left it all to the spoiled, eldest son.

(Fun fact: Inheritance laws were so complicated that the Persians invented algebra and fractions just to calculate them. So now you know who to blame for failing high school math.)

Inheritance law kept things a lot fairer, and it worked pretty well until the rise of the corporation around 1600, which made places like Italy, England and the Netherlands very, very rich. Why couldn’t the Muslims get in on this? Well, let’s say Ahmed heads to Italy to see Guido (equal opportunity racist here), hoping to go in together on shipping Egyptian cotton. Guido says sure, they sign the document combining their assets, and Guido slaps Ahmed on the back. Ahmed chokes on a piece of ravioli and dies.

Now Guido’s screwed. He just signed half his interests with Ahmed, but now instead of one partners he’s got fifteen heirs to deal with. If he wants to buy back Ahmed’s share or sell his own, he’s got to hit up each one of them, and if he wants to continue the venture, every decision’s gotta be made by him and as many relatives as feel like showing up to the board meetings. Now his goiter’s acting up while he’s got a woman in a hijab screaming at him in Arabic about Spanish tariffs. When Moustafa drops by the next week, Guido pretends he isn’t home.

So Moustafa got left out in the cold, while the Western economic system boomed. They built huge piles of cash, which financed bigger and bigger projects that made even more money, until corporations became some of the most powerful economic, political, and even military institutions in the world. The East India Company (the bad guys in Pirates of the Caribbean) essentially became its own country, with a private navy and sovereign territory. It was creepy; by the end they were taking in more from taxes than from business revenue.

That creepiness was at the heart of the whole issue – Arabs didn’t like the idea of a company that existed independent of its owners, able to make its own decisions and pursue its own interests. I can’t say I blame them, given the way things have turned out in the Western world, where government policy is often set by companies that don’t have armies but do have lobbyists, which are a lot scarier and more effective. But corporations have also improved the standard of living for the average human being to a level that would have been unimaginable two hundred years ago, and the Muslim world missed out on that.

Eventually they started corporations of their own, around the nineteenth century or so, but by that point it was too late. The Middle East had been playing by its own rules for too long, and they’d missed the massive changes that had restructured the global financial system. They’ve never caught up.

Things worked out basically the same way with Islamic loans (sukuk). The Koran forbids riba, or lending at interest rate, as do both the Bible and the Torah, and it does so for some very good reasons. To start with, it tends to transfer money from the poor to the rich. Then there’s the basic concept of “no pain, no gain”– you shouldn’t make a profit off something without taking a risk. And on a philosophical level, the law was trying to prevent money from becoming alive. When money was invented, it was just supposed to be a stand-in for physical stuff; you exchange it for a new plow because hauling your chickens around everywhere ends up with shit on your pants. Charging interest lets money make more money just by existing, which is dangerous. Something that is alive can never be fully controlled.

Example: by 2008 the finance industry had become the largest driver of wealth in the world. Slick suits gave out loans, which paid riba, and then traded that riba with other suits themselves, pretending it was a real thing. They ground up a bunch of ribas and slopped them all together, like concrete made of pulverised dreams, and used that concrete to build more and more complicated financial structures. But they forgot that these ribas were based on real loans, taken out by real people, and when enough of those people stopped paying the concrete collapsed, taking the world economy with it.

So how do you give a loan without riba? You give a Sharia-compliant loan called a sukuk, and for a long time these were really just investments. Guy comes to you, says he’s got a great business model, you plunk down the cash. If he pulls it off, you’re rich, if he goes down, you lose everything. That means that you’re going to be pretty damn careful who you lend to, and the total number of loans is going to stay small, precluding the creation of a finance industry.

Again, this worked fine until the Western economic system shot some steroids and started tossing around giant piles of money. Businesses were able to start projects on a scale that had previously been reserved for kings and madmen, building guns and armadas and kicking off the Industrial Revolution. So the Middle East fell further behind, simply by staying in place. Eventually most Muslim economies just gave up on the whole no-riba thing, but the delay had been fatal.

The ironic thing is that Arab Christians and Jews didn’t have any of these problems. Along with everything else, Islam was one of the most openly tolerant religions in the world (legally, anyway), so they didn’t impose Islamic laws on non-believers. The Muslim world became a great place to do business for non-Muslims, and by the time the 20th century rolled around, they held almost every major financial position in the Middle East.

It’s worth noting that there has been some innovation. About thirty years ago they came up with a new kind of sukuk that works more like a classic loan. Basically, if I need a boat, the bank buys my boat and sells it back to me a month at a time, charging slightly more for their trouble. By the time I’ve paid it off, the bank has made a tidy profit for itself, pretty much exactly the same amount they would’ve made if they’d just lent me the money at interest. This has two problems: one, it’s basically a traditional loan with a fancy name; two, if I can’t pay then the bank gets my boat. What the hell is a bank going to do with a boat?

Even so, I’m not going to make fun of sukuks here - they’re pretty good investments. Because they weren’t built on this crazy web of riba, they actually survived the financial crisis better than Western funds, and because they’re so weird, they attract investors from all over the world who want to put their eggs in a bunch of different baskets. The biggest constraints right now is the small size of the market, but it’s growing fast – projected at 30% this year alone.

That kind of thing makes me happy, because it’s an example of the flexibility you need to operate in the modern world. The Middle East stagnated for centuries because it couldn’t find that kind of flexibility; couldn’t find the balance between progress and faith. If it’s ever going to approach its old glory, it’ll need to keep refining that balance.

This column hasn’t been an indictment of Muslim business law. If anything, it’s a lament. Some days I wish we lived in a world where wealth was more equal, where companies existed within men instead of vice versa. I definitely wish that riba were illegal whenever I look at my student loan balance. But none of us gets to choose the world we live in, only how we adapt to it.

- Previous Article I Got Banged!

- Next Article Nomades Land