UAE Electronics Platform NorthLadder Scores $10M Convertible Note

The startup, which facilitates the frictionless trade of second-hand electronics will look to expand geographically, with KSA in its crosshairs.

Highlighting the increasing demand for alternative forms of funding in MENAP, UAE-based second-hand electronics trading platform, NorthLadder has announced a $10 million convertible note spearheaded by CE-Ventures, the corporate venture capital platform of the Sharjah-based Crescent Enterprises. Supporting investment also came from BECO Capital, Venture Souq and the Dutch Founders Fund.

Also referred to as convertible notes or convertible debt, convertible notes are essentially a type of short-term loan that is repaid in equity. Although this comes off the back of NorthLadder’s $5 million Series A round in early 2021, convertible notes are a particularly valuable form of fundraising when it comes to seed investment, as the notes are automatically converted into preferred stock shares for investors/lenders once a startup closes its Series A round.

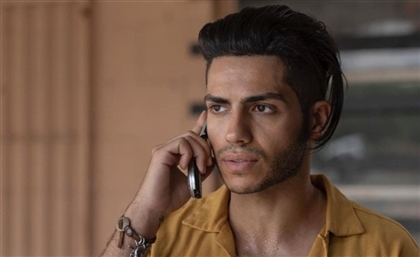

For NorthLadder, a platform that allows frictionless trading and is built on value and convenience, the new funding will be channelled into scaling its tech, expanding B2B partnerships and expanding its reach geographically. Since its founding by Mihin Shah, Pishu Ganglani, Ricky Husaini and Sandeep Shetty in 2019, NorthLadder claims to have served over 30,000 customers through its 500-plus dealers and 200 trade-in locations.

“We have always envisioned building NorthLadder into a global business,” said co-founder, Sandeep Shetty, who also serves as the company’s CEO. “With this latest round of funding, we plan to further strengthen our talent base and expand our market reach in multiple countries including the UAE and KSA. Affordability, driven by trade-ins, is a key enabler for the sale of new devices and we are excited about powering this for our partners, through our unique global business model that ensures the best residual value for second hand devices.”

The investment continues the boom of the region’s ecommerce sector, with Q1’22 seeing startups across MENAP and Turkey raising $260 million across 36 deals. With Pakistan’s Bazaar, KSA’s Nana and Turkey’s n11.com raising major rounds, there has been growing attention towards B2B and q-commerce startups, while Egypt came in first with the most number of transactions, thanks to rounds by the likes of Brimore, Capiter and MaxAB among the highlight deals.

Beyond the region, though, this round’s investors see NorthLadder’s potential to expand globally. “Northladder is trying to solve a complex problem by establishing micro-networks in emerging markets on the demand side of the pre-owned electronics market,” said Laurens Groenendijk, Founding Partner of Dutch Founder’s Fund. “Although many companies attempted to disrupt this value chain, NorthLadder's approach is ingenious and strengthens the circular economy. It is a global business, and we also see considerable potential in European markets.”

Meanwhile, Tushar Singhvi, Deputy CEO and Head of Investments at Crescent Enterprises, added that “with the UAE being the global hub that it is, the company is uniquely positioned to dominate the regional market and capture a significant portion of the global trade.”

High praise indeed

Trending This Week

-

Apr 03, 2025